how to become a tax preparer

How to Become a Tax Preparer

Gain flexibility, job security, & no cap on your income as a tax preparer

There's currently a shortage of qualified tax preparers. Plus, taxes aren't going away any time soon. The combo makes a career in tax a very attractive option!

Things you don't need…

- You don't need to be a CPA

- You don't need to know accounting or high level math

- You don't need a college degree

- You don't need prior tax knowledge

Tax preparer benefits

- A recession-proof career with no cap on income

- A flexible work schedule

- The possibility to work from home

- A professional, marketable skill

- Knowledge that enables you to save on your own taxes

Follow these 4 easy steps & you'll be preparing tax returns in just weeks

Step 1: Take a Top-Quality, Beginner Tax Preparation Course

The Comprehensive Tax Course starts with the basics, assuming no prior tax knowledge. This hands-on income tax course will teach you to:

- Prepare tax returns for most Form 1040 individual, non-business taxpayers

- Prepare tax returns for most self-employed/Schedule C taxpayers

- Research tax issues

About the course:

- 5-star rated program

- Register any time you like

- Online, self-paced – available 24/7

- 6 month term but many finish in 10 weeks or less

- CTEC approved qualifying education provider for CA

The course includes:

- Comprehensive Tax Course – 2021 Edition is Better than Ever, with Revised Content, Practical Pointers, & More!

- CA State Supplement Available

- Surgent ITS Support by Email

- Certificate of Completion after each of the four modules

- FREE 6-Hour AFTR Course

- Also available in a 2-course bundle or as part of a certificate program

Step 2: Obtain a PTIN

A PTIN – also known as a Preparer Tax Identification Number – is issued by the Internal Revenue Service (IRS) to paid preparers. IRS regulations requires anyone who prepares, or assists in preparing, federal tax returns for compensation to have a valid PTIN before preparing returns. You must renew your PTIN annually.

Applying for your PTIN is easy, and only takes about 15 minutes online. There is a $35.95 nonrefundable fee, which can be paid by Credit/Debit/ATM card.

You'll need the following for your PTIN application:

- Your Social Security Number

- Your Personal Information (name, mailing address, date of birth)

- Your Business Information (name, mailing address, telephone number)

- Your previous year's individual tax return (name, address, filing status)

- Explanations for any felony convictions

- Explanations for any problems with your U.S. individual or business tax obligations

- If applicable, any U.S.-based professional certifications information (CPA, attorney, Enrolled Agent, enrolled retirement plan agent, enrolled actuary, certified acceptance agent, or state license) including certification number, jurisdiction of issuance, and expiration date.

IMPT: You should obtain your PTIN as soon as possible to get things moving along. You don't need to wait until you complete Step 1.

Step 3: Check Your State for Tax Preparer Requirements

- Tax return preparer regulations vary widely by state. So be sure to check with the state you live in to see if you have specific requirements that you must meet. States like California, Connecticut, Iowa, Maryland, New York, and Oregon, do have requirements.

- State requirements for tax return preparers can range from nothing, to annual registration, a required beginner course, and/or a state exam that you must pass. You may also have continuing education requirements. Many states still don't have any requirements!

Step 4: Continue Your Education

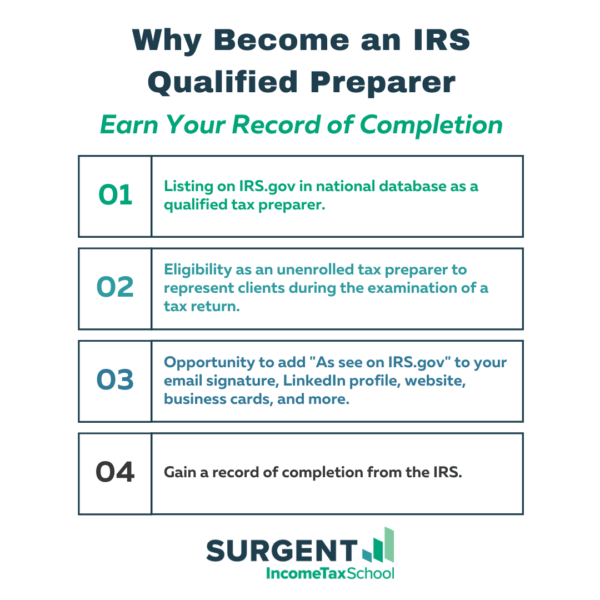

Once you complete the Comprehensive Tax Course, you can easily pass the IRS Annual Filing Season Program (AFSP), which includes the Annual Federal Tax Refresher Course (AFTR). This is a voluntary program, not a requirement. So, you don't have to do this extra step, but it is a wise move!

BONUS: When you register for the Comprehensive Tax Course with Surgent Income Tax School, you receive a FREE 6-hour AFTR (Annual Federal Tax Refresher) Course at no additional cost.

Upon completion of both courses (Comprehensive Tax Course and AFTR Course) and registering for your PTIN, you can be approved as an IRS Qualified Preparer and receive an AFSP – Record of Completion from the IRS.

The AFSP program sets non-credentialed tax return preparers apart from their competition, and also gives preparers some representation rights for their clients.

This is an exciting time to be a tax preparer and it's important to stay current with the ever-changing tax laws. In addition to keeping up with the changes, you should also consider learning some new things each year. Learning advanced individual and small business tax information will enable you to take on more complicated tax returns. This new knowledge will help you gain confidence as a tax preparer, continue to grow in the field, and expand your tax practice.

Get Started with a Career in Tax Preparation Today!

how to become a tax preparer

Source: https://www.theincometaxschool.com/tax-courses/how-to-become-a-tax-preparer/

Posted by: wrighteirchey.blogspot.com

0 Response to "how to become a tax preparer"

Post a Comment